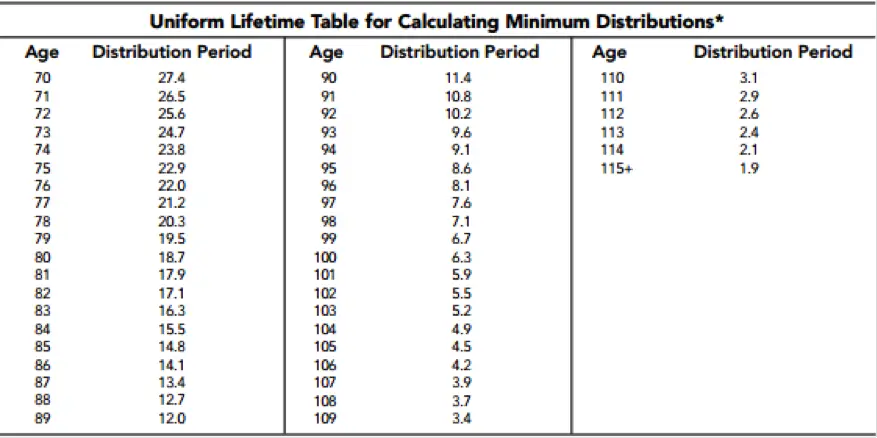

Reduce beginning life expectancy by 1 for each subsequent year take entire balance by end of 5th year following year of death table 1 single life expectancy appendix b publication 590 b.

Single life expectancy table irs 2017.

4 761 90 100 000 21 0 2017 life expectancy factor revised annually for spouse beneficiaries based on the irs single life expectancy table 20 2.

Reduce the life expectancy by 1 for each year after the year of death.

2016 life expectancy factor based on the irs single life expectancy table 21 0.

A period life table is based on the mortality experience of a population during a relatively short period of time.

Use the life expectancy listed next to the owner s age as of his or her birthday in the year of death.

66303u distributions from individual retirement arrangements.

Qualified 2017 dis aster retirement plan distributions and repayments for.

12 31 2016 fair market value 20 2 fair market value of inherited ira on 12.

Irs s table i for single life expectancy.

Worksheets sample forms and tables which can be found throughout the publication and in the appendices at the back of the publication.

Fidelity does not provide legal or tax advice.

That factor is reduced by one for each succeeding distribution year.

Getting your financial ducks in a row.

The information provided by fidelity investments is general in nature and should not be considered legal or tax advice.

Divide the account balance at the end of 2019 by the appropriate life expectancy from table i single life expectancy in appendix b.

Here we present the 2017 period life table for the social security area population for this table the period life expectancy at a given age is the average remaining number of years expected prior to death for a person at that exact age born on january 1 using the mortality.

Internal revenue service publication 590 b cat.

Designated beneficiaries use this single life expectancy table based on their age in the year after the ira owner s death.

Spouse beneficiaries who do not elect to roll the ira over or treat it as their own also use the single life table but they can look up their age each year.